38 zero coupon bond journal entry

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and...

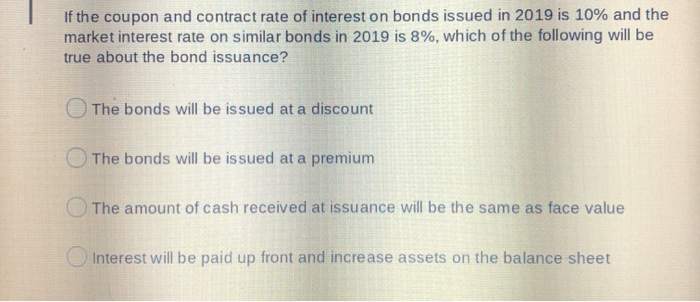

Bonds Flashcards - Quizlet Which of the following are true about Zero coupon bonds (more than one may be true): A. A zero coupon bond pays interest each period B. The market value of a zero coupon bond is just the discounted value of the final par value payment. C. Zero coupon bonds are issued at par value. D. Zero coupon bonds are issued at below par value

Zero coupon bond journal entry

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero-Coupon Bonds: Definition, Formula, Example ... - CFAJournal What are Zero-Coupon Bonds? A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is … Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

Zero coupon bond journal entry. Zero Interest Bonds | Formula | Example | Journal Entry - Accountinguide Please prepare the journal entry during issuing and the annual interest expense. As the company issue bonds at zero interest rate, we need to calculate the selling price first. Selling price = $ 100/ (1+6%)^5 = $ 74.72 Company needs to sell bonds at $ 74.72 per bond. So the company will receive the cash of $ 74,270 for selling 1,000 bonds. Deferred Coupon Bond | Formula | Journal Entry - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. Please calculate the bond price that company needs to sell to attract investors. Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond. accountinguide.com › investment-in-bondsInvestment in Bonds | Journal Entry | Example - Accountinguide When the bond is redeemed by the issuer at the end of its maturity; Solution: On January 1, 2020. When the company ABC purchases the bond for $10,000 at its face value, it can make the investment in bonds journal entry on January 1, 2020, as below:

Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000. Bonds in Finance Questions and Answers | Study.com Six year 9% bonds with a $450 000 par value are issued at a price of $479,435. Interest is paid semi-annually. The journal entry to record the issuance of … Zero Coupon Bonds's Journal Entries | Svtuition Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor g... Fountain Essays - Your grades could look better! Journal article. Project. Response essay. Reflection paper/Reflection essay. Presentation/PPT. Analysis (any type) Outline. Memo/Letter. Literature Analysis/Review. ... Barriers to Entry. Undergrad. (yrs 3-4) Logistics. 2. View this sample Research paper. Reflecting on Adult Education/Training. Master's.

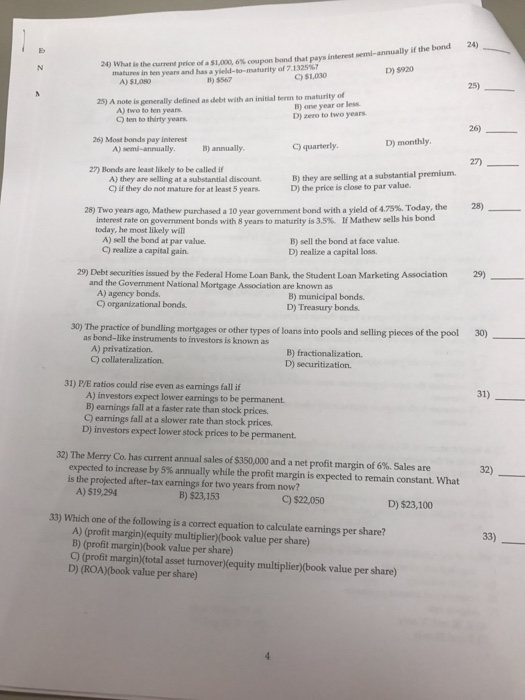

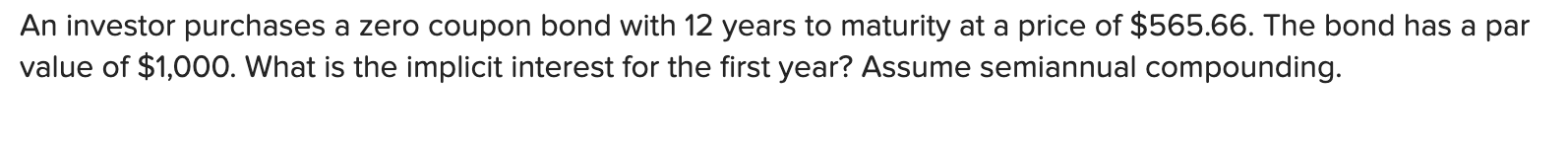

accountinguide.com › accounting-for-bondsAccounting for Bonds | Premium | Discount | Example ... Journal entry at the end of first year: On 31 Dec 202X, Company records debit interest expense of $ 7,588 ($ 94,846 * 8%), credit cash paid $ 6,000 and Discount bonds payable $ 1,588. Company record interest expense base on the market rate but pay to investor base on coupon rate, so the different will credit bond discount which will be zero at ... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Mortgage-backed security - Wikipedia A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment bank) that securitizes, or packages, the loans together into a security that investors can buy.Bonds securitizing mortgages are usually … Recording Entries for Bonds | Financial Accounting | | Course Hero Premium on Bonds Payable ($105,250 cash - $100,000 bond) 5,250. Bonds Payable ($100,000 bond amount) 100,000. To record issue of bond at a premium. The carrying value of these bonds at issuance is equal to the cash received of $105,250, consisting of the face value of $100,000 and the premium of $5,250.

Investment in Bonds | Journal Entry | Example - Accountinguide When the bond is redeemed by the issuer at the end of its maturity; Solution: On January 1, 2020. When the company ABC purchases the bond for $10,000 at its face value, it can make the investment in bonds journal entry on January 1, 2020, as below:

Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning.

Accounting For Bonds Payable - principlesofaccounting.com This topic is inherently confusing, and the journal entries are actually clarifying. Notice that the premium on bonds payable is carried in a separate account (unlike accounting for investments in bonds covered in a prior chapter, where the premium was simply included with the Investment in Bonds account).

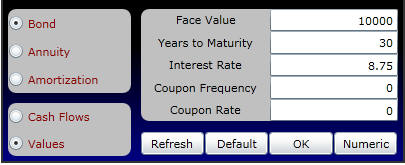

Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... Accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cas...

Journal Entry for Bonds - Accounting Hub Therefore, the journal entry for semiannual interest payment is as follow: This interest payment will start from June 30, 2020, until December 31, 2039. At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders.

Accounting Zero Coupon Bonds Journal Entries coupon bonds journal entries zero accounting. Adjusted store and restaurant reviews to include Yelp when tapping "Nearest" button. An optional and repeatable group of data elements which together describe a work which has a specified relationship to the product described in the ONIX record.

Answered: YMMV Inc. issues a 6 year bond with a… | bartleby Texas Corporation has a level-coupon bond with a 9% coupon rate and is paid annually. The bond has 20 years to maturity and a face value of RM1,000; similar bonds currently yield 7%. By prior agreement, the company will skip the coupon interest payments in years 8, 9, and 10. These payments will be repaid, without interest, at maturity.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

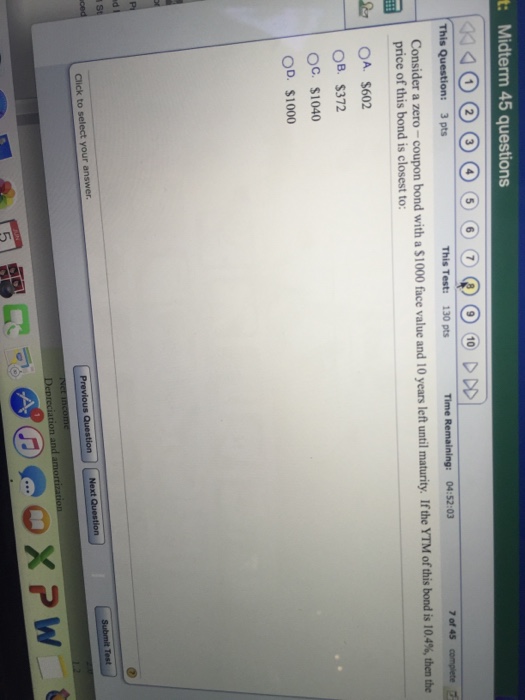

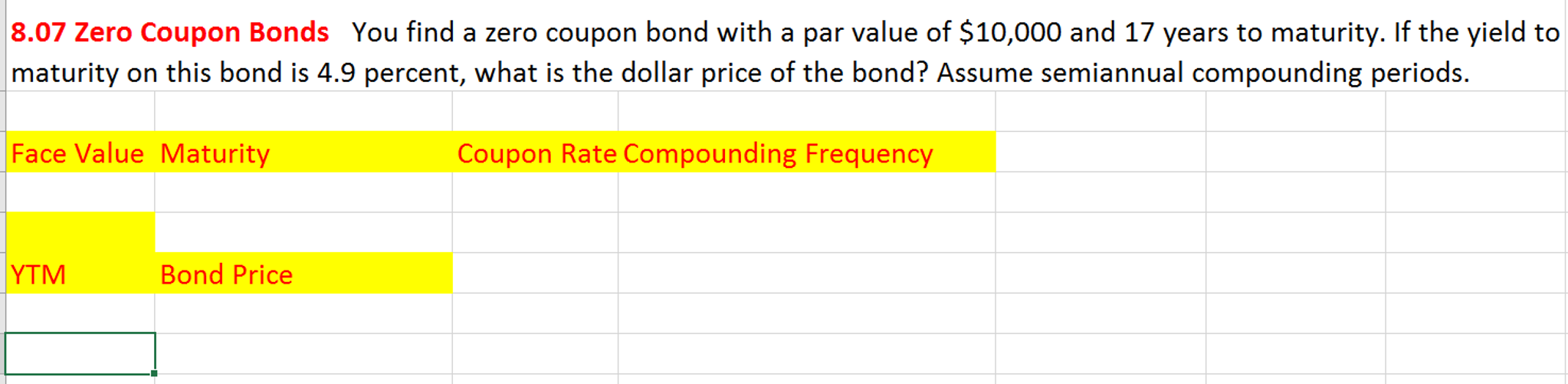

Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0%) ^ 20. PV = $554. The price of this zero-coupon is $554, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return.

› questions-and-answers › ymmv-incAnswered: YMMV Inc. issues a 6 year bond with a… | bartleby Texas Corporation has a level-coupon bond with a 9% coupon rate and is paid annually. The bond has 20 years to maturity and a face value of RM1,000; similar bonds currently yield 7%. By prior agreement, the company will skip the coupon interest payments in years 8, 9, and 10. These payments will be repaid, without interest, at maturity.

Accounting Zero Coupon Bonds Journal Entries Accounting Zero Coupon Bonds Journal Entries, Ink Coupons Staples, Bowviper Coupons, Kohls In Store Coupon November 2020, Cheerleaderhairpieces.biz Coupon Code, Train Tickets Deals London, Baby Ddrops Coupon ...

PubMed Moved Permanently. The document has moved here.

Accounting for Zero-Coupon Bonds - Lardbucket.org Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term "compounding." Describe the theoretical problems associated with the straight-line method, and identify the situation in which this method can be applied. The Issuance of a Zero-Coupon Bond

quizlet.com › 80520267 › bonds-flash-cardsBonds Flashcards - Quizlet Which of the following are true about Zero coupon bonds (more than one may be true): A. A zero coupon bond pays interest each period B. The market value of a zero coupon bond is just the discounted value of the final par value payment. C. Zero coupon bonds are issued at par value. D. Zero coupon bonds are issued at below par value

› dictionary › bondBond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction.

Post a Comment for "38 zero coupon bond journal entry"