41 treasury bill coupon rate

India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Treasury Bill - 36 months: Coupon Rate - BRITE Treasury Bill - 36 months: Coupon Rate reached 5.50% in March 2022. This is a monthly indicator for Lebanon released by the Banque du Liban.

Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Treasury bill coupon rate

Understanding Coupon Rate and Yield to Maturity of Bonds The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value...

Treasury bill coupon rate. Coupon Interest and Yield for eTBs - australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. Daily SGS Prices - Monetary Authority of Singapore Treasury Bills: Bonds : 6-Mth: 1-Year: 2-Year: 5-Year: 10-Year: 15-Year: 20-Year: 30-Year: Issue Code Coupon Rate Maturity Date BS22110W 29 Nov 2022 BY22101N 18 Apr 2023 ... Issue Code Coupon Rate Maturity Date BS22110W 29 Nov 2022 BY22101N 18 Apr 2023 N519100A 2.000% 01 Feb 2024 NZ07100S 3.500% 01 Mar 2027 TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Open 2.220% Day Range 2.125 - 2.225 52 Week Range -0.376 - 2.225 Price 2 4/32 Change -1/32 Change Percent -0.82% Coupon Rate 0.000% Maturity May 18, 2023 Performance Change in Basis Points Yield...

US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00 Treasury Bills (T-Bills) Definition - Investopedia A Treasury Bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are usually sold in denominationsof... Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Remarks by Deputy Secretary of the Treasury Wally Adeyemo at Consensus ... As Prepared for Delivery Thank you so much, it's great to be here with you in Austin. I especially want to thank CoinDesk for inviting me here today to discuss how the Treasury Department is approaching the digital assets landscape, and the role of regulation in promoting the kind of innovation we need to maintain U.S. leadership of the global financial system. I spend a great deal of my ... Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

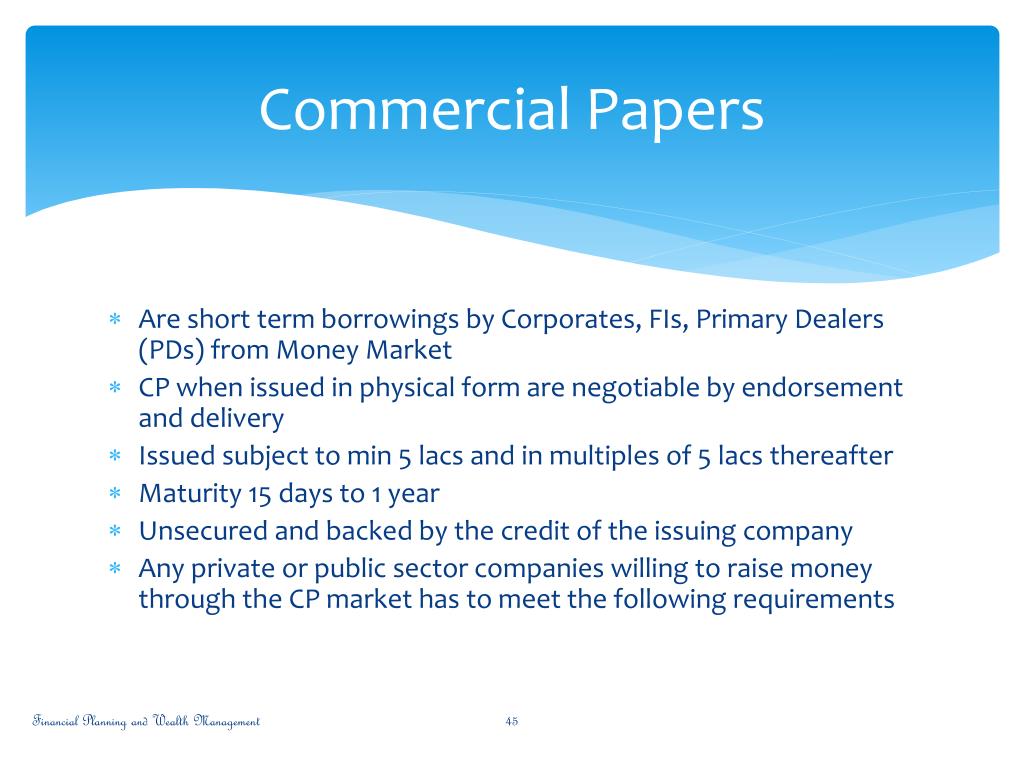

Investing in Treasury Bills: The Safest Investment in 2022 A Treasury bill is any bond issued with a maturity of one year or less. Treasury notes have maturities from two to 10 years. And Treasury bonds mature 20 years or later. (For simplicity, this article refers to all three as "Treasury bills" or "T-bills" or simply "Treasuries.") Treasury bills are seen as the safest bonds in the world ...

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

United States - Treasury Bills: 26-week - High rate Treasury Bills: 26-week - High rate for United States from U.S. Bureau of Public Debt for the Treasury auctions - 13- and 26-week (91- and 182-day) T-Bills release. ... but the coupon payments and underlying principal are adjusted to compensate for inflation as measured by the CPI. Therefore, the real rate of return is guaranteed, but the cost ...

United States Treasury security - Wikipedia Treasury notes ( T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Treasury Bill Rates - NASDAQ - Datastore The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the...

Treasury Bill (T-bill) Definition & Example | InvestingAnswers A Treasury Bill, or T-bill, is short-term debt issued and backed by the full faith and credit of the United States government. These debt obligations are issued in maturities of four, 13 and 26 weeks in various denominations as low as $1,000. Learn how to buy US Treasury bonds and T-bills online through TreasuryDirect.

Selected Treasury Bill Yields - Bank of Canada Treasury bills. Treasury bill yields presented are an average of sample secondary market yields taken throughout the business day. Data available as: CSV, JSON and XML. Series. 2022‑05‑11. 2022‑05‑18. 2022‑05‑25. 2022‑06‑01. 2022‑06‑08.

TMUBMUSD02Y | U.S. 2 Year Treasury Note Overview | MarketWatch 2-year Treasury yield drops 18 basis points to 2.54%, 10-year rate falls 13 basis points to below 2.77% amid flight to safety. Apr. 25, 2022 at 11:41 a.m. ET by Vivien Lou Chen.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

What are coupons in treasury bills/bonds? - Quora Treasury bills do not have a coupon rate; they are sold at a discount and redeemed at face value, also known as par value. Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually.

How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value...

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

Understanding Coupon Rate and Yield to Maturity of Bonds The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4.

Post a Comment for "41 treasury bill coupon rate"