43 advantage of zero coupon bonds

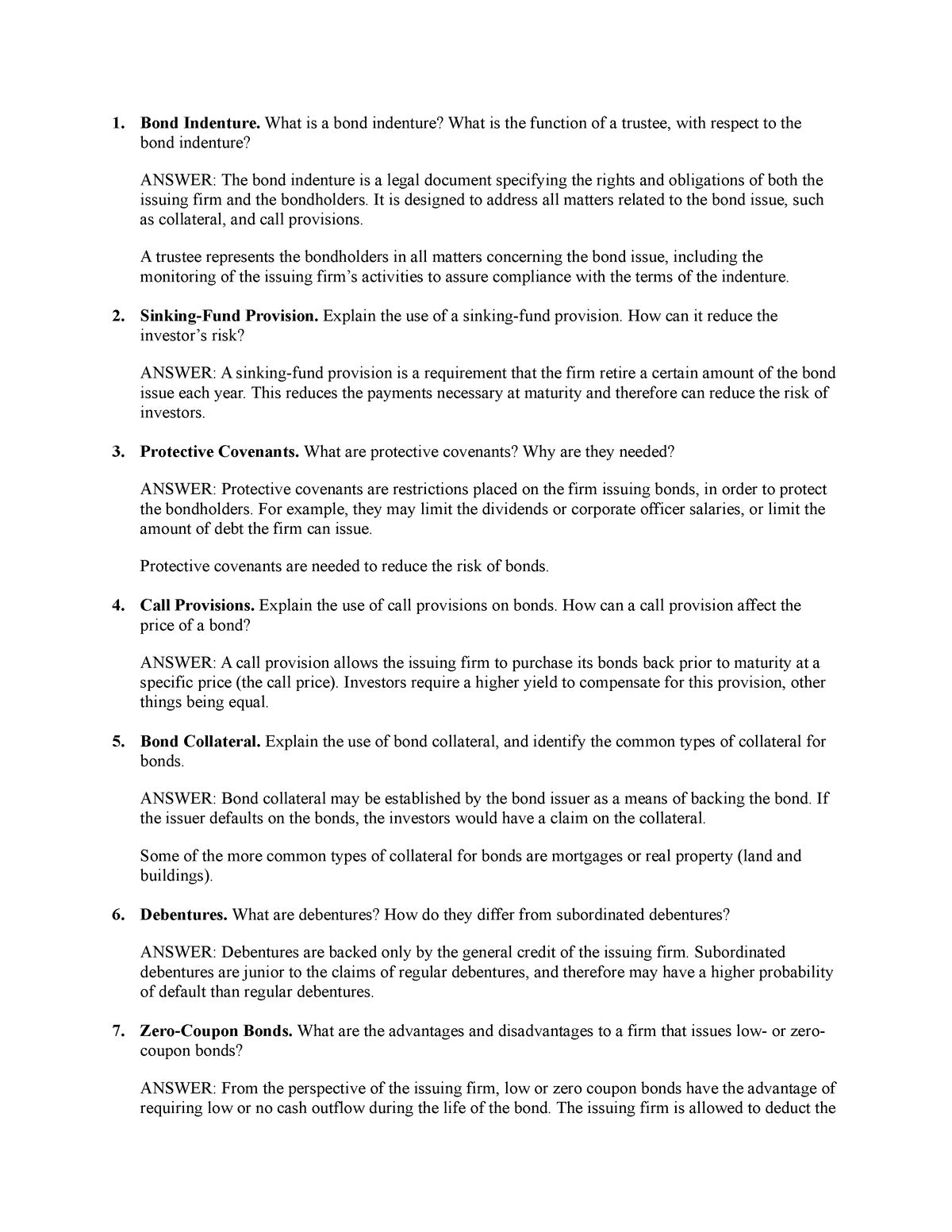

Pros and Cons of Zero-Coupon Bonds | Kiplinger Their big advantage is that you know how much you'll collect a certain number of years from now. In mid June, for example, you could have bought a U.S. Treasury zero for $341 that matures in August... Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

What are Zero Coupon Bonds? Explain some of its variants. Zero-coupon bonds (ZCB), also known as deep discount bonds do not carry any coupon rate. They are issued at a discount and redeemable at par. The amount of discount is equal to the total return for the investor. This can be expressed in terms of interest rate, called the implicit or inherent rate of interest.

Advantage of zero coupon bonds

What Is a Zero Coupon Bond? | The Motley Fool Over the 10 years, and you will collect a total of $30 in interest, plus, at the end of the term, the company pays you back your initial $100 investment. In contrast, with a zero coupon bond with a... What are the benefits to the issuers of zero-coupon bonds? The biggest advantage of a zero-coupon bond is its predictability. If you do not sell the bond prior to maturity, you do not have to worry about market ups and downs since you know what your investment will be worth at a particular future date. Hey dears, We have the most profitable stock trading chat room with live trade alerts. The ABCs of Zero Coupon Bonds | Tom Ammons - Affinity Advantage Zero coupon bonds are indeed debt instruments, but are issued at a discount to their face value, make no interest payments, and pay its face value at time of maturity. How Does it Work? Let's say, a hypothetical zero coupon bond is issued today at a discount price of $743 with a face value of $1,000, payable in 15 years. If you buy this bond ...

Advantage of zero coupon bonds. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Are there any advantages to zero-coupon bonds from the issuers ... The most obvious advantage for a corporate issuer of zero-coupon bonds is the high demand for this type of security. These bonds are priced much lower than current coupon securities with the same ... What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them... Advantages and Disadvantages of Bonds | Boundless Finance - Course Hero Convertible bonds: A convertible bond is a type of bond that the holder can convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price. Zero coupon bonds : A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ... Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. An Argument in Favor of Zero-Coupon Bonds - Financial Web Safety Another advantage of zero-coupon bonds is that they are considered to be very safe. There is a high likelihood that you are going to be able to get your money back out of this type of investment. When you are a bond holder, you are considered to be a creditor of the company that issued the bond. Zero-Coupon Bond - an overview | ScienceDirect Topics Moorad Choudhry, in The Bond & Money Markets, 2001. 14.5.2 Bond interest payment. Corporate bonds pay a fixed or floating-rate coupon. Floating-rate bonds were reviewed in Chapter 5. Zero-coupon bonds are also popular in the corporate market, indeed corporate zero-coupon bonds differ from zero-coupon bonds in government markets in that they are actually issued by the borrower, rather than ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. The... A zero-coupon bond is a discounted investment that can help you save ... Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way to make them... What Is The Advantage Of Investing In A Zero Coupon Bond - Atish Lolienkar What is zero coupon bond. Explanation with an example; Why are zero coupon bonds issued; Key highlights; Advantage of zero coupon bond. Guaranteed return; Does not depend on the market fluctuations; Does not hold interest rate risk & credit risk; Long term fund security; Sell off in secondary markets with high yields; Meeting future needs ; Conclusion Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Advantages of Zero-Coupon Bonds. It is important to understand the advantages of a Zero Coupon bond before opting for this investment. The advantages are mentioned below: No reinvestment risk: Other coupon bonds don't allow investors to a bond's cash flow at the same rate as the investment's required rate of returns.

Zero-Coupon Bonds | AnnuityAdvantage For example, a zero-coupon bond with a face value of $5,000, a maturity date of 20 years, and a 5% interest rate might cost only a few hundred dollars. When the bond matures, the bondholder receives the face value of the bond ($5,000 in this case), barring default. The value of zero-coupon bonds is subject to market fluctuations.

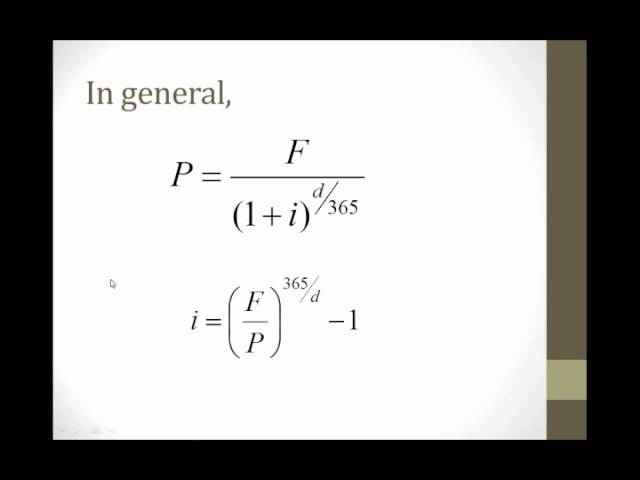

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero coupon bonds can work to your advantage, if used judiciously and in tandem with your investment objectives. Without any intermittent coupon payments, the calculation of yield to maturity of a zero-coupon bond is as follows: (Face value/ current market price) *(1/years to maturity) - 1;

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Following are the advantages of zero coupon bonds Significant returns on maturity These bonds are deep discount bonds that offer significant returns on maturity. Additionally, a bondholder can exit the bond by selling in the secondary market (stock market), in case the interest rates decline sharply. Fixed interest

Should I Invest in Zero Coupon Bonds? | The Motley Fool Because all of the return of a zero coupon bond gets incorporated into its price, changes in rates have a more dramatic impact on zero coupon bond prices than with their interest-paying...

Who can issue zero-coupon bonds? - Drinksavvyinc.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

What are the advantages and disadvantages of zero-coupon bond? What are the advantages and disadvantages of a zero coupon bond? Advantages (a) Growth and (b) avoiding the temptation to trade. That is you put in X$ and get back many times X when you are Y years old. Disadvantages (a) create phantom income. You must pay tax annually on the interest you are not receiving and (b) survival.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

The best advantage of a zero-coupon bond to the issuer is that the ... The best advantage of a zero-coupon bond to the issuer is that the Accounting MCQs | Accounting MCQs MCQs Papers Definitions Flashcards MCQs Papers Definitions Flashcards Categories Absorption Costing ACAMS Practice Questions Accounting Basics Accounting Cycle and Classifying Accounts Accounting For Managers Accounting for Merchandising Activities

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Since the Interest accrued is discounted from the Par value of such Bonds at purchase, which effectively enables Investors of Zero Coupon Bonds to buy a greater number of such bonds compared to any other Coupon Bearing Bond. Zero-Coupon Bond Formula We can calculate the Present value by using the below-mentioned formula:

Zero-Coupon Bond - The Investors Book Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below: Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

The ABCs of Zero Coupon Bonds | Tom Ammons - Affinity Advantage Zero coupon bonds are indeed debt instruments, but are issued at a discount to their face value, make no interest payments, and pay its face value at time of maturity. How Does it Work? Let's say, a hypothetical zero coupon bond is issued today at a discount price of $743 with a face value of $1,000, payable in 15 years. If you buy this bond ...

What are the benefits to the issuers of zero-coupon bonds? The biggest advantage of a zero-coupon bond is its predictability. If you do not sell the bond prior to maturity, you do not have to worry about market ups and downs since you know what your investment will be worth at a particular future date. Hey dears, We have the most profitable stock trading chat room with live trade alerts.

What Is a Zero Coupon Bond? | The Motley Fool Over the 10 years, and you will collect a total of $30 in interest, plus, at the end of the term, the company pays you back your initial $100 investment. In contrast, with a zero coupon bond with a...

:max_bytes(150000):strip_icc():gifv()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "43 advantage of zero coupon bonds"